Regressive QR Transaction Fees Hinder Efforts to Go Digital

There will reportedly be transaction fees applied to dealers who receive money through the DuitNow QR application starting on November 1, 2023.

A fee of 0.25% will be added to the trader's account if the payment is made from a current or savings account.

For credit card transfers, a fee of 0.50% will be charged.

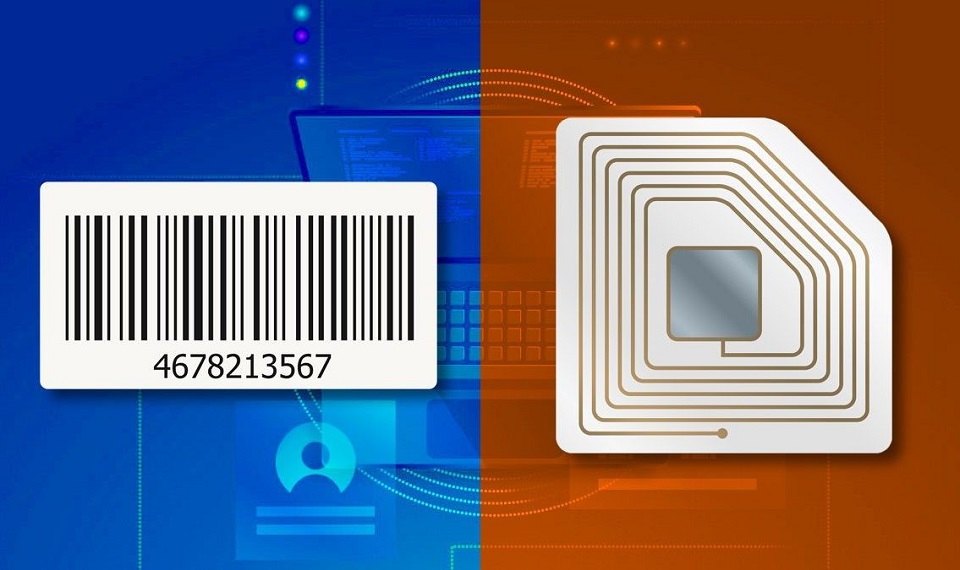

Money transfers between banks and non-bank entities are made possible via the DuitNow QR service by scanning QR codes.

It was created by PayNet in accordance with the Interoperable Credit Transfer Framework of Bank Negara Malaysia.

Regressive QR payment fees are negative to efforts to digitize

Whether the rumor that DuitNow will take a cut from businesses on all transactions is true or not has been questioned by the Small and Medium Enterprises Association (Samenta).

It has encouraged PayNet to respond right away as well.

"At the moment, QR payments are exempt, but debit and credit card payments are subject to MDRs.”

Yet, the MDR exemptions for DuitNow QR payments would be removed as of November 1, 2023, it stated.

In regards to the first payment type, PayNet stated that it will split the MDR collected with the relevant banks and third-party acquirers.

This also includes the costs incurred by banks and acquirers for network maintenance, it was said.

The RM0.50 fee mentioned in the reports only applies to peer-to-peer fund transfers between personal QR codes, not to payments to merchants, according to PayNet.

It stated that "this fee is unrelated to the aforesaid MDR and will not be imposed on the same transaction."

Samenta claimed that while it had been working hard to encourage SMEs to digitize, its efforts would be affected by charging merchants such transaction costs.

Read more: DuitNow QR Charge Is Being Waived Permanentl

0 Comments

Leave a Comment

Your email address will not be published. Required fields are marked *